Section III Extra Credit Posts for Spring 2023

For March 10

Holy crap (yes, that's the technical term for it). There's been a bank run ... right at the time I'm covering bank runs in class.

This is a still developing story, so expect more posts about this. In fact, many news sites are running live updates on the topic, which some of you may enjoy following.

On Friday, SVB, the 18th largest bank in the country was shut down after being driven into bankruptcy by mass withdrawals.

Digression: international students will be shocked to learn, and domestic students should learn, that the U.S. has a highly decentralized banking system, composed of thousands of small banks. In fact, "big" American banks are often quite small compared to those in many other countries. This is probably a good thing: it helps spread out risk.

Anyway, problems with SVB apparently started appearing early last week (I missed it too). By Thursday, there were mass withdrawals, and on Friday the state of California shut them down, and handed over the keys to FDIC.

This is especially shocking. This is FDIC's job. I have never heard of a bank being shut down by state regulators. It speaks to incompetence inside the FDIC, which for a generation or so has been thought to be a pretty tight ship. FDIC does not report to the Federal Reserve, or the Department of the Treasury, but it also reflects poorly on the top echelons of those organizations.

While we're on that issue, there are also accusations that the problems at SVB may be related to something I'd call dereliction of duty amongst its executives.

The big issue for the next few days is that this bank run be stopped before it spreads to other banks. Bank runs are "contagious" — not in the same way as germs, but with much the same surface appearance as the illness passes between random contacts.

Preventing that sort of contagion has a pejorative name in the media and public: bailouts. No one wants bailouts, but the key thing is to reduce the need for them, not avoid them when they're necessary.

So as of Sunday night, we've seen another bank in New York get closed, and a subsidiary of SVB in Massachusetts too. And in the evening, the Fed and Treasury have come out with plans that ares already being called bailouts.

For March 8

I stalled on this one until Calculated Risk updated his cool charts.

Here's two thoughts for you.

There's an idea floating around that lots of people are quitting their jobs because somehow the macroeconomy has changed.

There's a lot of people who claim to be macroeconomic experts who have very little macroeconomic understanding.

People like me, who actually know the data, use it to get at the truth. And then we tell it to students in the hope that they'll listen and learn.

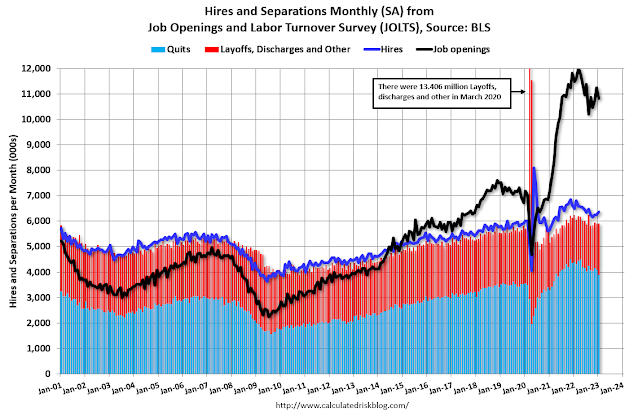

So let me introduce you to JOLTS data. That's short for Job Openings and Labor Turnover Survey. It's been around for just over 20 years, and can tell us a lot about what people are actually doing, rather than the wishful thinking of pretend economists.

This shows 4 things.Quits are in light blue. Layoffs and discharges (aka firings) are in red, and they are stacked on top of quits. This means that the solid part is people leaving their jobs.

In those two, COVID-19 and the lockdowns are easy to spot. And so unusual as to not really be informative about anything else. The recessions are obvious in the light blue: people are a lot less likely to quit their jobs in a recession. Interestingly, the layoffs and discharges are about the same all the time (the top of the red and the top of the light blue are roughly parallel). This tells us that bosses and owners are not "out to get" their workers ... even in recessions.

Now, note the upward trend in the light blue: this is during expansions. Most of this is increasing population: more people means more people quit. Records in the light blue have to be treated with care, because note that they happen all the time as we trend upward. Saying a trending series has hit a new record is about as useful as saying you set several new records in the past week for total number of breakfasts you've eaten in your life.

It's useful to follow the trend in the light blue from before COVID-19 and the lockdowns, and extend it mentally further to the right. If you do that, all the talk about record numbers of people quitting their jobs is that little hill that's already been done for several months. In short: it's a nothingburger. It's not quite a fib, but it's close.

Now let's look at the demand side. The dark blue line is hiring. Businesses are doing a good job of hiring all the people who quit, and all the people who are laid off or fired, and some extras.

But the HUGE STORY in the labor market in the U.S., that NO ONE BUT MACROECONOMISTS IS TALKING ABOUT is the black line. This is job openings. Businesses have crazy numbers of jobs they're willing to hire for (the blue line should be higher), but for which they cannot find decent applicants. There are two reasons for this: applicants are often unqualified, and applicants often can't pass a drug test.

I'm not here to get all moral on college students about drug use. It's just a fact that insurance companies push many firms to require drug tests. And I probably don't have to tell college students which drug is detectable for the longest period of time. What I will tell you is that the initial uptick in that black line corresponds to the opening of retail marijuana stores in Colorado and Washington in 2014, and that further upticks in the black line can be fairly tightly associated with other states doing the same.

Macroeconomic poseurs and cannabis advocates won't tell you that.

For March 6

One of the things you should pick up from Chapters 11-12 is the importance of keeping monetary policy independent of politics. This has been standard in principles books for 35 years.

One of the things macroeconomists have learned over the last 80 years(and that politicians have not) is that the political system in most countries is not set up in a way that makes fiscal policy very useful or inclined to be appropriately used.

Part of this is broad recognition across countries that monetary policy works better than fiscal policy — and is covered first in textbooks and classes — when central banks operate independently of the political sector. The classic symptom of this lack of independence across countries is higher inflation rates, as politicians attempt to influence votes in the next election with excessively expansionary monetary policy.

Unfortunately, in the U.S., both parties have been encroaching on the political independence of the Federal Reserve. The FOMC, which makes monetary policy, is composed of Fed Governors and Fed Bank presidents. Both of those have historically been drawn from banking professionals, banking regulators, and academic macroeconomists who happen to specialize in monetary economics.

And the Biden administration has gone big on this. Dialing backwards, Obama appointed Lael Brainard, who resigned as Vice Chair of the Fed just a couple of weeks back to move laterally into the Biden cabinet. Her specialization was not monetary economics. To that, the Biden White House added Lisa Cook who's done a little work on monetary economics (but mostly other stuff), and Phil Jefferson who has done mostly monetary economics research, but not very much of it, and who is mostly known as a university administrator, and Michael Barr ... a law professor with seemingly no particular interest in conducting monetary policy effectively.

All of this is background. The Federal Reserve Bank of Chicago recently appointed Austan Goolsbee as its president. Goolsbee is a very good economist, but again does not specialize in monetary economics. But ... he had the correct pedigree, having served in the Obama White House. And, Fed Bank presidents vote on the FOMC on a rotating basis, and the Chicago president gets to vote for the next 3 years. These appointments need to approved by the Governors.

This is where an informed student needs to read between the lines. Two of the Governors (who came from the traditional backgrounds for Governors) abstained from the vote. To many this suggests that they didn't approve of the nomination, but didn't have the votes to shoot it down. This appears to be unprecedented.

The importance of this is that we have an inflation problem. If inflation is bothering you (and others) then we ought to be truthful about its source. The appointment record of the Biden administration (and holdovers from the Obama administration) is consistent with a preference towards high and sustained inflation.

Meanwhile, the Biden White House has blamed inflation on a multitude of other sources: Trump, Russia, oil prices, COVID-19, lockdowns, supply disruptions, meat producers, profiteers, greedy business people, monopolies, and so on. Watch what people do, not what they say.

P.S. There's strong suspicion that Goolsbee is the preferred choice to replace Brainard as Vice Chair. Up until now, his lack of monetary policy items on his resume would have precluded his nomination for that post.

P.P.S. One of the Governors who abstained rather than vote on Goolsbee had a virtual event with 220 invited financial professionals cancelled last week, after it was Zoom-bombed with porn.

For February 23

I had an ulterior motive for not covering this in class on Wednesday the 21st: the data I wanted to show you came out the next morning.

In January, I talked about the advance estimate for GDP for 2022 IV. I mentioned that this was a rough draft, and the revision would come out in a month, and it did. Usually the revisions move the numbers a few tenths of a percentage point one way or the other.

The real GDP growth rate was revised downwards from 2.9%/yr to 2.7%/yr (both are annualized). Both are OK numbers: a little below average.

The measure of inflation used to make that calculation was revised upwards from 3.5%/yr to 3.9%/yr (annualized). Note that while this is an inflation rate, it's not the inflation rate that most people talk about (which is based on the CPI, and is often higher). While these numbers are lower than in early summer last year, they're still more than double (and maybe triple) what's desirable.

This is just sharpening the accuracy of the numbers, so it's not like we can feel this change.

***

All posts from before the 3 day weekend were covered on Exam 2.

Comments

Post a Comment