Section 4 Extra Credit Posts for Fall 2022

For November 29:

The source for today's is pages 1-9 of the PowerPoint slide deck in Module 4 entitled "Why Is Macroeconomics So Hard?"

The ones below here are the extras from Section III that I said would be fair game for questions on Exam 4.

For November 15:

Personally, it's hard to write these posts sometimes. I want to do a little every day, but some days, or weeks, not much happens macroeconomically. :( That's the way Fall 2022 was. Election years are like that: no one wants to rock the boat right before an election. Voters might remember something recent. But over the last couple of weeks, the macroeconomic news has been blossoming like crazy. :-o

I have tried to limit my linking. Most of this can be found just by googling.

A good way to keep on top of this story is to go to the complementary online Wall Street Journal subscription you have, and look for the link that says "Today's Action" at the top of the page. Sorry, I can't direct link to that (it changes all the time).

***

There is a full-blown "bank" run happening right now, except it's not in the banking industry, it's in the cryptocurrency exchange industry. Both are part of the financial sector (and I'm using sector and industry interchangeably here).

Bank runs are rare. They were not that rare a century ago.

It seems that deposit insurance works. But macroeconomic policy is non-experimental: we can't control or do away with all the other stuff that might influence financial markets. Maybe deposit insurance is useless, and we're just fooling ourselves. It doesn't seem so, but don't forget that possibility.

Banking is one of the most heavily regulated industries out there. Get the causality right: it is regulated because bank runs did happen; it is not bank runs happen so we need more regulations.

But complying with regulations is costly. Those costs are paid out of the the interest earned from lending, reducing the amount that can get paid out to depositors. So depositors look for places to put their money that are bank-like, but less regulated.

These are called shadow-banks. The financial crisis in 2006-9 had runs on shadow-banks.

Cryptocurrency is stuff like bitcoin, ethereum, and a host of others. People who haven't had enough macroeconomics think cryptocurrency is special because it's created inside the financial system but without banks. Those who have had macro through Chapter 10 should respond with — "Duh. Tufte and the Colander text taught me about inside money".

A lot of cryptocurrency is handled through exchanges. If it's money, there has to be someone you can exchange it with or it doesn't have value. So these exchanges host accounts for cryptocurrency, and allow you to exchange it with others, sometimes for stuff that isn't cryptocurrency. People who haven't had enough macroeconomics think cryptocurrency exchanges are special because they provide intermediation. Those who have had macro through Chapter 11 should respond with — "Duh. Tufte and the Colander text taught me that the financial system is us and intermediation is how we're connected together".

So anyway, cryptocurrency exchanges are shadow-banks. You can earn more in them because they're not as regulated as banks. For that, you get a greater risk of runs.Bingo.

The run started with breaking news about a particular cryptocurrency exchange called FTX about 10 days ago. Basically, the money wasn't where it was supposed to be. It doesn't matter if it's currency or cryptocurrency: if the money is there you trust, and if it's not you don't. Now it's leaked out slowly over the last week that FTX's management was doing sneaky stuff (here, and here). But nothing we haven't seen in other institutions: it doesn't matter if it's fraud or cryptofraud — if your money was used decently you trust, and if it's not you don't. Oh, and the principals in FTX were making (ridiculously) huge campaign donations to one party. Those who have had macro through Chapter 12 should respond with — "Duh. Tufte and the Colander text taught me that rent seeking is a common problem when we fool ourselves into thinking the regulators aren't human.

The phrase tossed around for this in finance is "the math always wins". Basically, if you do the math right, and the answer you get it contrary to the reality you see around you, eventually reality will change. In short, if you think everything is different this time, think again.

***

No macro in this section. But don't you think people should have been suspicious when it became public that the principals of FTX were cohabiting in a $40M penthouse in an exclusive gated community in The Bahamas, replete with MIT graduates, children of Stanford and MIT professors, Harry Potter fanatic larping aficionados, and a secretive Asian-American computer coder who doesn't seem to have ever talked to actual humans very much? It sounds like James Bond villains for the age of wokeness.

***

On the subject of the demands for regulating cryptocurrency exchanges that are going to crop up very soon, here's Scott Sumner writing at Econlog (retired macro professor who worked at Bentley College):

So what’s the argument for new regulations of crypto? Surely not the fact that Bitcoin prices have plunged by 75%? Surely not the fact that creditors to FTX are going to lose their money? Surely not that fact that there are accusations of fraud in the recent FTX collapse? These are all either normal parts of our financial system, or are already outlawed by regulation. So what is the specific argument for additional regulation of crypto? To “protect crypto investors”? Why would we want to do that? To protect the banking system? I’ve seen no evidence that crypto threatens the banking system.

Do we really want to make people who invest in crypto feel safer about their investments? Wouldn’t that make “bubbles” even more likely? Isn’t it healthy for crypto investors to fear they might lose their investment? Wouldn’t it make them more careful?

...

Again, there may be market failure arguments of which I am unaware. But “bankruptcy and fraud” are not textbook examples of market failure that require regulation. One is a part of any well functioning market, while the other is already illegal. It may seem obvious to you that “something must be done”, but it is not at all obvious to me.

***

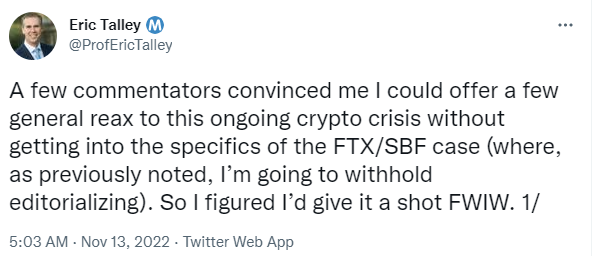

And here's a tweet storm from Eric Talley (a professor of financial law at Columbia). Reproduced in full since tweets can be hard to link to permanently:

We talk a lot in contemporary society about the importance of "lived experiences". Talley's lived experience and mine are just about the same. Perhaps the world would work better if we paid more attention to the lived experiences of people with some expertise in something worthwhile.

***

Still curious? Last semester, student RC recommended (and I finally watched) the documentary "Line Goes Up" on YouTube.

For November 10:

Let's go easy today. The BLS will announce the inflation rate of the CPI at 8:30 am EDT. I was able to update this morning, highlighted below.

Calculated Risk has the expectations:

The consensus is for a

0.7% increase in CPI, and a (0.4%/year actual)

0.5%/year increase in core CPI. The consensus is for CPI to be up (0.3%/year actual)

8.0%/year year-over-year and core CPI to be up (7.7%/year actual)

6.6%/year YoY. (6.3%/year actual)

(I'm not sure where he gets the "consensus" from, but he's the type of person who would collect that data on the side, just for fun. In turn, that different investment advisors, like Goldman Sachs, produce their own expectations for sale to clients).

Most of any "news" tomorrow will be whether the actual numbers are a surprise compared to those. Remember to think clearly about this: the actual numbers are not good, they're awful. But even awful numbers can be better than expected. Also, this is measuring something that already happened, so we lived through the awfulness, thus the response to finding out it was not-quite-so-awful will be positive.

Comments

Post a Comment