Section 2 Extra Credit Posts for Spring 2023

For February 17

The BLS released the CPI on Tuesday, and the PPI on Thursday.

The PPI is the Producer Price Index. The CPI is prices you and I pay, the PPI is the prices our employers pay for the stuff we use on the job.

The usual thinking is that changes in the PPI get passed on to consumers several months later, where they show up in the CPI.

And ... it was up by a lot: 0.7% over the month, and 6.0% over the last year. The former is a little worse than expected. The latter rate has been dropping, but it's still probably 2-4 times higher than we'd like it to be. That's the way inflation works: when it's too high, it's too high for a while. We're going on about 2 years of this now.

Keep the PPI in mind the next time you hear a politician or someone in the media say that inflation is easing up. Maybe a little, but the PPI isn't indicating that it's going to go away any time soon.

For February 15

There are a ton of different measures of inflation, but the big ones are derived from the Consumer Price Index (CPI), or from the Personal Consumption Expenditure (PCE) Price Index covered here a few weeks ago.

The CPI comes out monthly while the PCE comes out quarterly, so we tend to hear about the CPI 3 times as often in the news.

The CPI is collected by the Bureau of Labor Statistics (BLS). Their website is more accessible than most, so I encourage students to go poke around there a little (BLS.gov).

Both the CPI and the PCE are price indexes (or some might call them measures of the price level). A price index is just a weighted average of prices, with the weights determined by how much you and I buy.

What makes the news is the inflation rate. This is the rate of change of either of those indices.

But it's the price level that corresponds most closely to the P on the axis of the AD-AS model covered in class.

The CPI for January was announced Tuesday morning. The news release trumpets the inflation rate (of the CPI) which came in a little higher than expected, at 6.4%/year.

But for today, I want to go through one of the links at the bottom of that press release and look at the index itself. It shows the index is at 299.170. This is measured relative to a base period, which for the CPI is 1982-1984. What that number means is that the stuff that cost a consumer $100 back then, now costs $299.17. So prices are about 3 times as high as two generations ago.

For February 13

Pretty much everyone thinks something like "I didn't learn much in school", or "what I learned in school didn't help me much".

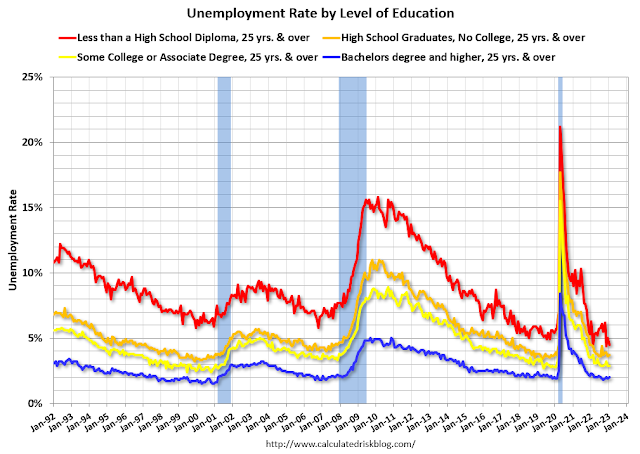

The unemployment rate tends to support this. Check out this chart from Calculated Risk:

It shows the unemployment rate broken down by how much school workers completed. It's common knowledge that the less educated are more likely to be unemployed. But the pairs here show something more interesting.

The difference between the orange and the red is more school but not necessarily very much more — the big distinction between them is whether the worker graduated from high school or not.

The blue and yellow do the same thing, but with college.

Economists think this is because it really doesn't matter as much what you learn. Instead, education is signalling (see the section on asymmetric information in your micro text) that you can complete things you start.

For February 10

I noted in class on Monday that our "folk macroeconomics" is upside-down about the trade deficit. Check out this graph from Calculated Risk covering almost 30 years:

We have a trade deficit when our imports exceed our exports. On this graph, that's the distance between the red and blue lines. A bigger trade deficit means that gap between them has gotten larger.We are told endlessly that trade deficits arr a bad thing. Yet look at the chart; in recession they get closer together, and in expansions the gap between them opens up. So those people are telling you that recessions are a good thing because they make the trade deficit smaller. That's crazy!

***

Do you know people that think every time you're having a good time that you're doing something wrong? They are controlling the public discussion of this topic.

***

We have a lot of international students in this class.

Germany, South Korea, Nigeria, and recently Italy and Mexico are running trade surpluses. This is not good: it's working extra and getting less for it.

France, Spain, and the U.S. are taking advantage of those countries by importing more than they export.

For February 6

Last Friday the monthly report on the labor market came out. It's produced by the Bureau of Labor Statistics (BLS). They're less important than the BEA but the BLS has a much more user friendly website! (link is just for curiosity, not required)

What is required is this chart from Calculated Risk's post about the report.

In class, I noted that the civilian non-institutionalized population over 16 can be thought of as people who "can work", while the labor force is people who "will work".

The participation ratio (red on the graph) is "will work" divided by "can work". It shows demographics (like the baby boom) well, but not business cycles.

The employment-population ratio (blue on the graph) is the employed divided by "can work". It shows those demographics but also business cycles (whereas the unemployment rate only tracks the business cycles).

Note for both of them that we are still below the levels from early 2020 just before COVID-19 hit (note that the dashed lines are showing something else).

For February 3

Going easy on you today :)

As expected, the FOMC raised their target interest rate by a quarter point.

If you're really interested in that sort of thing, you can watch the whole press conference here (definitely not required or even recommended ... it's just a principles class). Do note that it's recorded live, and starts when they're good and ready, so it doesn't actually start until the 59 minute mark, and then goes for about 45 more minutes. The guy speaking is Fed Chairman Powell. There's also a transcript.

The rate increase is announced within the first minute. In finance, they talk about "basis points". These all mean the same thing: quarter point, 0.25%, 25 basis points.

Not long after that, he discusses some of the pieces of data you've already learned about: PCE inflation, labor force participation, and so on.

For February 1

I had an ulterior motive for putting this post into Section 2.

Later on today, the FOMC is going to hold a press conference to announce their new policy.

The FOMC (covered in Chapter 11) is the part of the Federal Reserve (covered in Chapters 10-12) that determines monetary policy (covered in Chapters 8 and 11-12). The expectation is that the policy announced Wednesday afternoon will be to raise their interest rate target by 0.25%.

It may not seem like a lot, but any increase in that target is intended to "hit the brakes" on the economy. They want to slow it down because that's just about the only way to reduce inflation. But it will be painful, so the question is really which will hurt less: more inflation, or higher interest rates?

They move in quarter point (0.25%) increments. And they are making the decision right now while you're in class, so we can only guess what they'll do. If they raise their target by 0.50% they are choosing higher interest rates to get even less inflation. If they keep their target unchanged, they are choose more inflation because the interest rate increase might be more painful.

For this one, I'm again going to direct you to the first page of results of a Google search. Type in "FOMC", get the results, and then click "News". Four million hits right now.

***

While Exam 1 is still a week away, since I moved it back, all posts from February 1st onwards will be sources for potential short answer extra credit questions on Exam 2.

Comments

Post a Comment