Section IV Extra Credit Posts for Spring 2023

March 31

There have been many rumors around that the banking problem this month have come through social media, with Twitter often accused. Congress seems quite interested in pursuing this avenue.

Meanwhile, Bloomberg reports that it wasn't (open) social media that was the problem, but rather (closed) thing like chat rooms, What'sApp groups, and old-fashioned phone calls.

Check out "SVB’s Demise Swirled on Private VC, Founder Networks Before Hitting Twitter" for interviews with people who were caught up in this new type of bank run.

March 29

No, it's not normal for me to be doing so much about a banking crisis in 2020, but it is the big macroeconomic news lately.

This week we're learning that FDIC had finally found a buyer for the American portion of Silicon Valley Bank (SVB). Emphasizing again, when banks go bankrupt, the money isn't lost (usually), but rather is in the form of other assets that aren't as liquid. So FDIC is usually looking for a buyer that has a lot more liquidity. Usually that means a bigger bank.

Except this time. Because this is a really goofed up situation.

We're not party to whom the FDIC talked to, but you'd have to think that a lot of potential buyers ... passed. Usually FDIC has this all worked out in advance, and it's now almost 3 weeks late.

And you'd think they went to big banks first.

Where they ended up was way down the list with a bank out of Raleigh, North Carolina, called First Citizens Bancshares. This operation is roughly half the size of SVB. Now it will be in the top 20.

And ... they had to be ... hmmm ... enticed. With a lot of free money. Digging deep into the numbers, Wasteland Capital shows that First Citizens didn't buy all of SVB, and that they were given $16B to buy what they did.

The word bailout is thrown around a lot, often inappropriately. This isn't a bailout, it's more of a bribe. Usually bribes go from the private sector to the public sector. In this case, it's the opposite: the FDIC is using taxpayer money to bribe a (solid) bank to buy a failed bank, because they can't find any volunteers.

BTW: In a press conference, a Brazilian investor noted that "any intern" would have been able to see the risk in SVB's business model. “After 15 years of zero rates you have a whole generation of traders,

portfolio managers, economists, analysts that don’t know these basic

concepts,” he said. “They only know inflation by text book, people never

saw a hawkish central bank or positive real rates, and so this is the

dislocation that we’re dealing with.” Greg Orman at RealClearPolitics noted much the same thing: "Over the past four decades ... The SVB failure highlighted a risk in the banking the system that has largely been dormant over that period."

UPDATE: Oh wait, FDIC isn't going to hit up taxpayers for the money to fund the SVB purchase, but rather is going to levy a fee on the big banks that passed on taking it over. Sheesh. FWIW, those banks have been complaining for almost 15 years they were set up by D.C. to look like the bad guys in the financial crisis of 2006-2009.

March 27

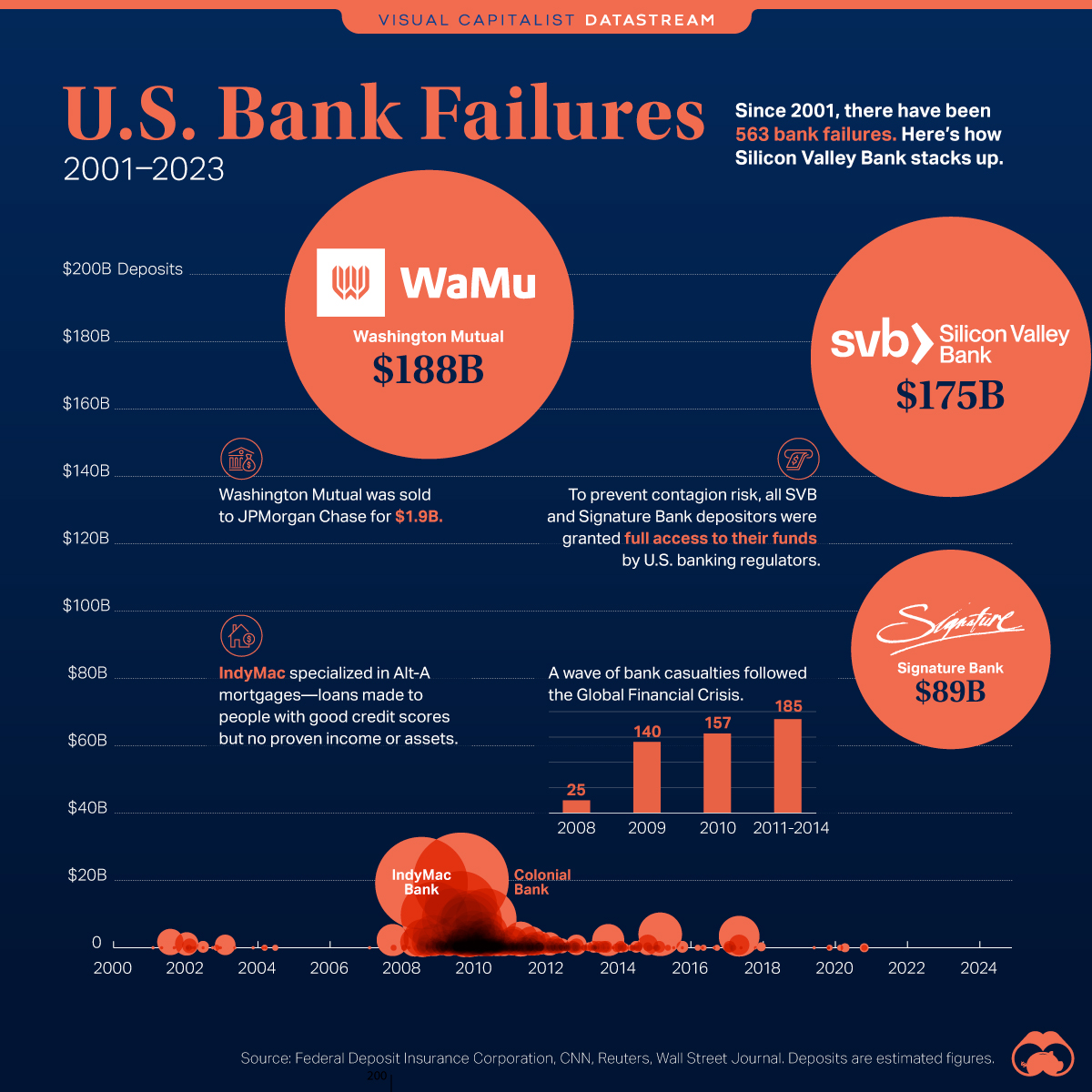

This is from Visual Capitalist, a good site for infographics, and short posts.

This gives you some sense of the timing and size of recent bank failures in the U.S. Prior to this month WaMU and IndyMac were the 2 biggest. WaMu still is (barely). Do keep in mind that almost all macroeconomic and financial numbers grow with the passage of time: WaMu was the 6th biggest bank when it failed, SVB was 16th amongst a group where they're all bigger. Even so ... it's not good when any bank fails.

Banks do fail intermittently in the U.S., but they're mostly small, local, operations (often with just one branch). The financial crisis of 2006-2009 is fairly obvious in the timeline at the bottom.

Due note that when they list assets, this is how much the bank owned to earn income from when it failed (typically a few percent of that each year). It is not losses to depositors (most bank failures don't lead to much in the way of losses, but rather your money being tied up for weeks or months). For WaMu, it notes that it was bought up for about 1% of the value of its assets, indicating that the buying bank figured they could sort the whole thing out, pay any penalties and fees, and still make money off the deal.

March 24

This is a cool think you don't see every day. An article about the experiences of an FDIC executive who was roped in to managing the re-opening of IndyMac Bank (a Pasadena bank that failed in the summer of 2008). It's entitled "Veteran of FDIC Takeover Tells What It’s Like to Run a Failed Bank", and it talks about how they flew in secretly, how the old CEO had already packed up and left, who got hired and fired, and how they calmed the depositors that waited in line for their money. This is the Wall Street Journal, so you'll need your complimentary subscription. It may not be your thing (other than I'm making you read it), but it's the first time I've ever read an insider account like this.

March 22

Ummm ... FDIC still hasn't found a buyer for SVB. This is what they usually do before the bank fails, not after. They're trying to auction its parts, and finding zero buyers.

***

There have been a lot of rumors around that SVB was a "woke" bank and this contributed to its failure.

There is zero evidence to support this.

Having said that there is something called "affinity fraud" that applies here. In this case, it's more like affinity mismanagement, but the principal still applies. Affinity fraud is what happens when someone lets their guard down around someone that is like them, and then gets cheated. It seems quite plausible that SVB was collecting deposits from people and firms who liked its message so much that they didn't do enough due diligence to check if it was a good bank. Bloomberg reports that over 900 European investment firms with "woke" leanings had money in SVB.

March 20

The big news over the weekend was the takeover of Credit Suisse by USB (both are Swiss banks).† Both were in the top 50 for banks internationally. The merged bank will be in the top 15.

The situation in the U.S. over the last 10 days did not help Credit Suisse, which does have a lot of operations here (it was top 50 in the U.S. too). But this is more of a classic bank failure: Credit Suisse has been in trouble for over a year. And what we're seeing is an orderly takeover by a healthier competitor to prevent bank contagion.

The important point macroeconomically is that the financial crisis of 2023 is not over yet, and it's not limited to the U.S.

The late news on this merger is that the price UBS agreed to pay for Credit Suisse depended on them getting inside Credit Suisse and getting an advance "look at their books". The initial offer was about $1B, and the final offer was about $3B, indicating that things weren't as bad as they thought they might be.

Having said that though, the deal would not have gone through at all if the Swiss National Bank didn't guarantee some of Credit Suisse's assets. This is a bad sign, and indicative that the Swiss government was very worried about the possibility for a bank run.

† Saying "Swiss bank" is kind of a loaded phrase. Switzerland is a small, but rich and developed country. They have lots of firms (and banks) with an international presence. But they do also have those tighter bank secrecy laws, and those are best viewed as just another lucrative line of business that banks in Switzerland can pursue.

March 17

The financial crisis is still simmering.

The bank people are worrying about now is First Republic. It is a tad smaller than Silicon Valley Bank was (just last week), so roughly top 20.

The worry with this bank is similar to Silicon Valley Bank: lots of large, uninsured depositors, who might bail if they get panicky.

A consortium of other larger banks has gotten together and volunteered to deposit money in First Republic, to improve its liquidity. This is uncommon, but not unheard of.

March 15

Serial internet found Jon Wu has tweeted some clues about what was wrong with SVB.

In short, it's hard to describe an operation like this as a bank. It was more like a lending club.

- Interest only loans to startups that first got investment money elsewhere

- But if you borrowed from them, you were supposed re-deposit it and bank with them too.

- No collateral needed.

- Deals on mortgages for officers of corporations who borrowed from them.

***

Greg Mankiw (yeah, the guy that wrote the macro book that kids in others classes use) noted that the "stress tests" used by regulator to assess bank risk ... didn't include a test for the current environment of rising rates, and instead were testing for risk from falling rates ... which we haven't had in about 15 years. Yikes. No wonder they didn't find anything.

March 13

So, we had a fully fledged bank run, mostly last Thursday. The target was Silicon Valley Bank (SVB), which has a single branch office in the Salt Lake area.

This run was mostly of large, uninsured depositors, making withdrawals electronically.

The news about this has been bizarre and unprecedented.

- The bank was closed on Friday by California state-level regulators, who then called in FDIC. I have never, ever, heard of this. It's points to FDIC not doing its job.

- Why on earth were there uninsured depositors? Banks have limits on what's insured that everyone knows (it's in every bank commercial on TV, ever). Firms hire chief financial officers with MBA's or MS degrees in finance, precisely where to put extra money safely because it won't fit into an insured bank account. Bunches of them seem to have not done this.

- No one seems to have thought through that if all these checking accounts were so huge, that the "insurance" those CFO's were planning on was withdrawing it all really, really, fast. As ... they did.

- The FDIC is responsible for banks when they look like they'll fail, and immediately afterwards. The Federal Reserve, specifically the regional bank in San Francisco, is responsible for regulating them before they fail. It appears to have dropped the ball, big time. Oh wait ... the CEO of SVB sat on the Board of Directors of the Federal Reserve Bank of San Francisco. You don't think he steered regulators the other way, do you??

- The Department of the Treasury also regulates banks, and appears to have not done its job this time around.

- SVB invested heavily in assets whose price would be expected to fall a lot when interest rates rose ... and did nothing to get out of those assets as interest rates rose. Duh.

- Michael Cembalist, who advises investors for J.P. Morgan about investing in banks, used publicly available information on the morning of March 10th to show that SVB was a house of cards ... all before the bank was even closed down. Regulators had all of this information. Heck ... they required it to be reported!!! Short sellers were warning about SVB as early as January.

- SVB did not have a Chief Risk Officer for a period of 8 months this past year. This is an absolute core executive position that every bank has. I have never heard of this sort of problem before.

Update: when banks fail, the money isn't lost, but it's in the wrong form (it's not liquid enough). So other banks (with better liquidity) are often easy to recruit as buyers. For SVB, regulators in the UK got HSBC to buy SVB's English operations. But the price they got was ... one pound. You read that right. This is a sign that the SVB situation is a lot more goofy than people recognize. That's not the price you pay for a bank's operations, that's the amount you pay for a bag of squirrels to do someone a favor.

Comments

Post a Comment